On this website, you will find tutorials for installing & managing software, lists of the best linux resources, and in depth guides to linux.

Join us on SlackA Positive Theory of Consumer Choice

Do you make logical decisions? If asked to make choices based on complicated circumstances, how often would you be right? The answer may surprise you - mental illusions in complicated decisions are the rule rather than the exception, according to research on judgment and decision making.

“The capacity of the human mind for formulating and solving complex problems is very small compared with the size of the problems whose solution is required for objectively rational behavior in the real world,” says Richard Thaler, a Nobel Laureate Economist. Thaler has taken research on how peoples’ guesses at solutions can be skewed, and applied it to economic models, showing that models of consumer choice consistently predicted incorrect consumer choices.

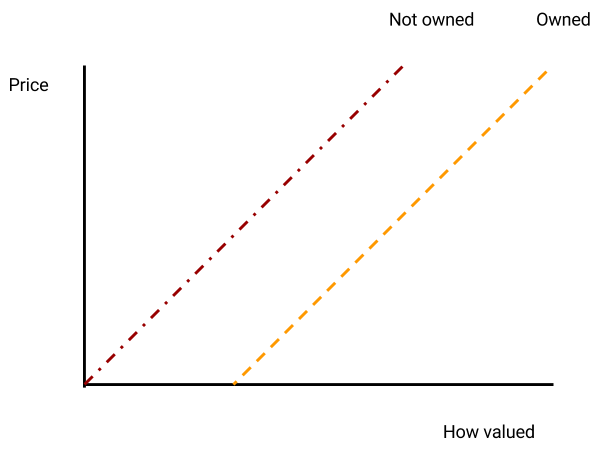

But to describe a better model, we first need some background. Expected Utility Theory, developed by von Neumann and Morgenstern in 1944, was created as a descriptive model of choice which used simple weights and arithmetic to predict consumer choices. In 1979, Prospect Theory was created as a counter to the widespread use of Utility Theory by Kahneman and Tversky, who analysed results of surveys and showed that Utility Theory did very poorly when comparing losses and gains. Prospect Theory fixed these issues and provided a better theory of consumer choice. However, it’s not perfect: Prospect theory fails to model the action of the cost of the product in determining if the product will be used.

Richard Thaler points this out; when a man pays for an expensive tennis membership but develops tennis elbow, he will continue playing, despite the pain, thinking that he should make the most of his money. However, when the tennis membership is cheap, he will stop playing. In other words, paying for the right to use a good or service will increase the rate at which the good will be utilized, ceteris paribus. This is referred to as the “sunk cost effect”.

The main take from Richard Thaler’s paper is that models should not be taken for granted. He explains that in this fashion: if there was a model for billiards players, the model for the expert players and the new players would be quite different, and we should not expect the model for the average billiard player to work in every case. The intermediate billiard player might think 1 or 2 moves ahead - far differently than how the expert looks 4 or 5 ahead, planning every move. Should there be one model for all of consumer choice? Of course not. Richard Thaler suggests that by using smaller, specific models can be far more accurate.

References

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.454.6386&rep=rep1&type=pdf